mobile county al sales tax

40-10-12 to verify the time and location of the Mobile County Alabama tax sale. 800 to 300 Monday Tuesday Thursday and Fridays and 800 to 100 Wednesdays.

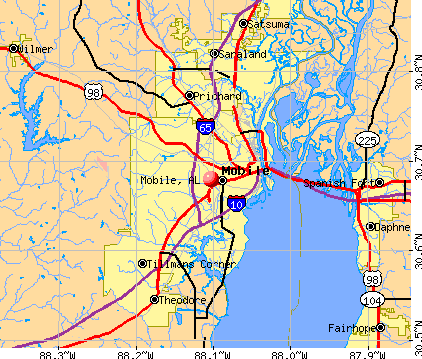

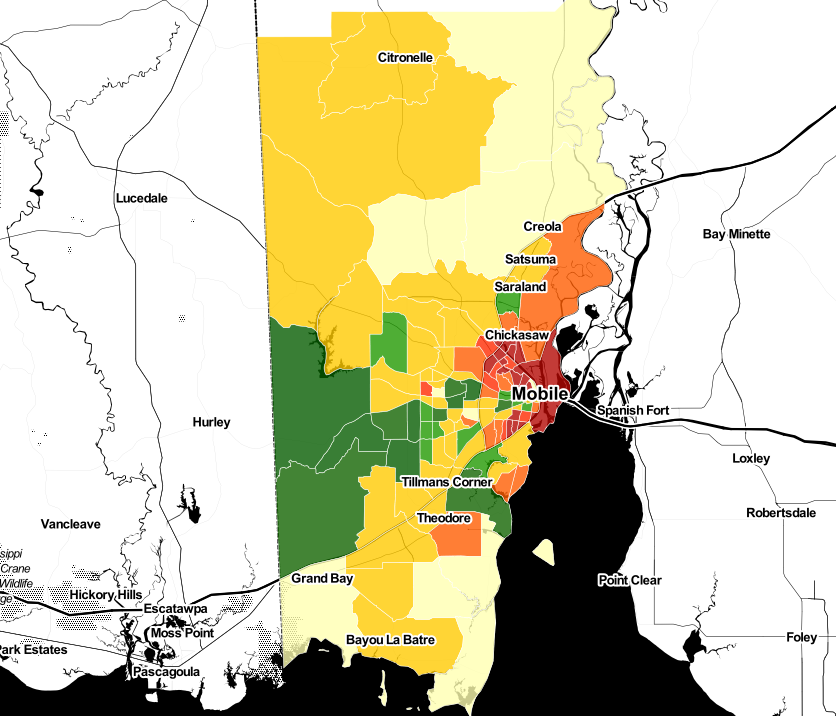

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mobile County property owners are required to pay property taxes annually to the Revenue Commissioner.

. The minimum combined 2022 sales tax rate for Mobile Alabama is. This is the total of state and county sales tax rates. Limited Mobile County Tornados Debris Pickup.

Real property taxes become due and payable on October 1 of each year and become delinquent if not paid before midnight December 31. Property owners are urged to pay all delinquent property taxes owed immediately to prevent any further action. The Alabama sales tax rate is currently.

Mobile County Alabama tax lien certificates are sold at the Mobile County tax sale which is held annually during April or May. Mobile AL 36652-3065 Office. Lowest sales tax 5 Highest sales tax 125 Alabama Sales Tax.

We continue to provide satellite offices in downtown. AL Sales Tax Rate. Mobile County Announces Art Contest for Earth Day.

The December 2020 total local sales tax rate was also 5500. This office is centrally located and offers ample free parking and handicap access. The December 2020 total local sales tax rate was also 10000.

Please contact Mobile County Revenue Commission to verify all information for accuracy. The County sales tax rate is. Mobile County Chief Election Officer Judge of Probate Don Davis seeks poll workers for the upcoming election.

Income Tax Rate Indonesia. Starting 211 - 2252022 hours will be Mon. To obtain a payment amount for a delinquent tax account please contact our Collections Department at 251-574-8530.

A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the 4 Alabama sales tax. Opry Mills Breakfast. Vending all other 4000.

Restaurants In Matthews Nc That Deliver. The purpose of the tax lien auction is to secure payment of delinquent real property taxes in Mobile County. Mobile AL Sales Tax Rate.

Some cities and local governments in Mobile County collect additional local sales taxes which can be as high as 45. If you need access to a database of all Alabama local sales tax rates visit the sales tax data page. The Mobile County sales tax rate is.

2022 List of Alabama Local Sales Tax Rates. Average Sales Tax With Local. Has impacted many state.

Married filing joint return4000 to 7500. Revenue Office Government Plaza 2nd Floor Window Hours. Download all Alabama sales tax rates by zip code.

The Mobile sales tax rate is. Limited to excess of 4 of adjusted gross income. The Mobile County Sales Tax is 15.

Mobile County Sales Tax Rates. Did South Dakota v. Click any locality for a full breakdown of local property taxes or visit our Alabama sales tax calculatorto lookup local rates by zip code.

The 2018 United States Supreme Court decision in South Dakota v. We also processes the monthly Mobile County SalesUseLease Tax. Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7.

Wayfair Inc affect Alabama. Delivery Spanish Fork Restaurants. Essex Ct Pizza Restaurants.

At the main office located at 3925 Michael Blvd Suite G Mobile AL 36609. Property record and appraisal information are for appraisal use only and should not be used for any legal purpose or conveyance. The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500 city sales tax.

In Mobile County Alabama real estate property taxes are due on October 1 and are considered delinquent after December 31st of each year. Mobile County Al Sales Tax Registration. Delinquency notices are mailed January 1.

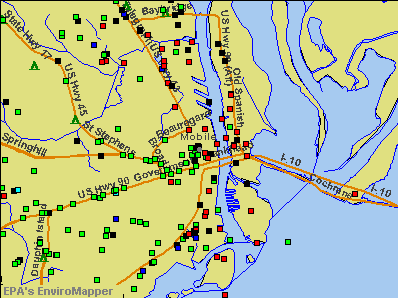

The current total local sales tax rate in Mobile AL is 10000. Soldier For Life Fort Campbell. You may search for specific tax information view maps or obtain and ask for general information concerning property tax in Alabama.

The Mobile Sales Tax is collected by the merchant on all qualifying sales made within Mobile. Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self. The Alabama state sales tax rate is currently.

Oxford 5 sales tax on the retail sale of alcoholic beverages by businesses licensed under Section 28-3A-21a6 Section 28-3A-21a7 Section 28-3A-21a8 Section 28-3A-21a14 or Section 28-3A-21a15 Code of Alabama 1975. Bayfront Park to be Closed to the Public March 31. Vending food products 3000.

The Mobile County Revenue Commissions annual property tax sale auction is scheduled for Thursday May 5 2016 beginning at 1000 am. Escambia County is encouraging residents to participate in Floridas 14-day Disaster Preparedness Sales Tax Holiday which began Saturday. The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which involves collection of monthly Sales Use Taxes and licensing businessesprofessions doing business within the Mobile License Tax Jurisdiction.

Mobile County AL Sales Tax Rate. The current total local sales tax rate in Mobile County AL is 5500. Our main office is located at 3925 Michael Square Suite G on the corner of Michael Boulevard and Azalea Road.

This is the total of state county and city sales tax rates. Our window hours will be extended for the Mardi Gras season. 800 to 430 pm.

The Food Service Establishment Tax is a five percent 5 sales tax levied in lieu of the five 5 general sales tax on the gross proceeds of sales at retail of.

The Mobile Al Real Estate Market Stats And Trends For 2022

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The Mobile Al Real Estate Market Stats And Trends For 2022

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Power Of Attorney Form Room Rental Agreement

Pin By Janice Pritchard On Jan S Documents Visa Card Numbers Credit Card Visa Visa Card

Grimco Delivering Wholesale Sign Supplies Printing Equipment To The Mobile Area With Same Or Next Day Delivery Available

Fire Chief Resume Examples Resume Examples Firefighter Resume Resume

Locations Mobile County Revenue Commission

Locations Mobile County Revenue Commission

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fun Things To Do With Kids In Mobile Al Family Travel Blog Travel With Kids

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders